The Truth About Invoice Factoring

Managing your finances includes the tracking of your accounts payable and receivable. Doing so will help keep your business running strong. All too often unpaid accounts and invoices pile up that have terrible consequences on businesses both big and small. Unpaid accounts can lead to a business failing to make payroll or being able to stock their shelves with inventory.

Sending Tony Soprano out to break kneecaps would be unethical. But hiring an invoice factoring service to handle cash flow problems and get your business back in the clear is an inexpensive, no-risk option that has kept thousands of businesses in operation when big banks refused to help.

Invoice factoring companies do what the banks won’t—they pay out the amount of the unpaid funds while creating invoices, leaving you free to run and manage your business affairs. Continue reading to learn more about this great service.

Empty pocket syndrome

It can take months to get paid on invoices that have piled up on your desk. Instead of making never-ending phone calls and firing off daily e-mails, you can find a factoring company that can advance you the funds and collect from your clients.

When you factor your invoices, the cash will appear in your account within 24 hours, and the factoring company takes 100 percent of the credit risk. Most of these services provide their expertise with no upfront fees and require a simple credit check. Once approved most businesses get up to 90 to 96 percent of the amount owed to them with the remaining figure going to pay for the service.

The buzz on the street

Critics in the financial world praise the benefits of invoice factoring for its ability to pay a business every time an issue occurs with their financial contracts. This helps entrepreneurs plan their cash flow more effectively. The service is also highly regarded due to the factoring company’s ability to play a role in managing the sales ledger and hunting down customers.

Another benefit to this option is that communication is top notch. Often a business is worried that hiring a third-party debt collector could tarnish valuable relationships with customers. Accounts receivable factoring companies work closely with businesses to collect the funds while maintaining those valuable client relationships with outstanding communication and sensitive etiquette.

Say no to banks

Trying to get a bank to offer the same service an invoice factoring company provides is like trying to convince the world that the Cubs will win this year’s World Series—you will be hard pressed to get a positive response. Cash flow complications happen with almost every business type, especially if you are in your first year of operations. But even thriving enterprises run into their share of problems. Banks offer very little help when it comes to these matters. Go online and compare costs and services between a traditional bank and an invoice factoring company—the differences will stun you.

Learning game

If you are new to business chances are you have never had to utilize an invoice factoring company before. This by no means is a sign of failure on your part, as all businesses face these challenges at one point. Make the most of the experience and go forward learning new ways to improve your business. You may also want to look into creating a position in your business for overseeing invoices and billing. This would free up more of your time so you can focus on improving the core of your brand.

How to Create a Business Plan and Get a Bank Loan in 5 Steps

How to Create a Business Plan and Get a Bank Loan in 5 Steps 4 Online Tools that Make Managing Your Money a Breeze

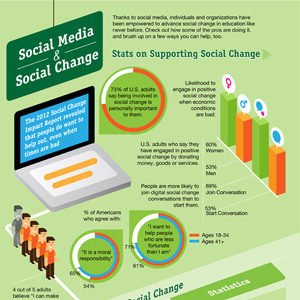

4 Online Tools that Make Managing Your Money a Breeze Social Media and Social Change [Infographic]

Social Media and Social Change [Infographic] Small Business; Turn negative things into positive by being creative and open

Small Business; Turn negative things into positive by being creative and open