Accounting is defined as “The system of setting up, maintaining, and auditing the books of a firm” and “A detailed report of the financial state or transactions of a person or entity.” But what accounting really is for a small business is life. Without accurate and lawful accounting practices a small business is more likely to fail. Unfortunately, most small business owners ignore this fact regularly. This can explain the high number of failing businesses.

1- Good Systems Equal Success

Having a good accounting system makes it much more likely that your business will be successful. You’ll be able to better know what is working and not working, and what you need to do in order to do better with a good accounting system.

2- Setting Up A System Is Simple Today

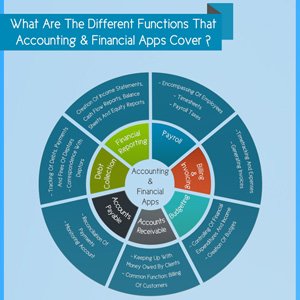

With all the online accounting software available today, at a price that fits your budget, you’ll be able to easily set up a system that works for your business. There is no excuse! Take a look at the infographic to get more information about online accounting software.

3- There Is Free Help

Almost every community has help for small businesses to find out the right information regarding their financial and accounting needs. If you’re in the USA contact SCORE to find out more about the expert business counseling they offer.

4- It’s More Than Taxes

Small business accounting is way more than just taxes. It’s about having a budget, identifying your profits and losses, as well as staying up to date on your accounts receivable and payable.

5- Learn Common Accounting Terms

Even if you hire a CPA and / or Bookkeeper, and if you’re not an accounting professional, you should, you need to know common accounting terms so that you understand what you’re signing when you sign anything of a financial nature.

6- Learn Basic Financial Statements

The most important financial statements in my opinion are your operating budget, your income statement and your balance sheet. Learn these statements backwards and forwards.

7- Open Separate Business Accounts

Yes, you need a business account that is separate from your personal account. Typically, this doesn’t matter if you have a micro business or a larger business. Keeping the funds separate will enable you to keep better track and avoid spending too much money.

8- Deposit Income Immediately

When you get paid, get the money into your account as fast as possible. And know, if you get a check on Dec 31st of the year, you’re not allowed to call it next year’s income. It’s income the date you get the check, even if you weren’t there to pick up your mail and you have to wait for the check to clear.

9- Don’t Put Your Fingers In The Till

Mostly, this is a problem in cash based businesses, where owners think that whatever is in the cash register on any given day can be used willy-nilly for parties, lunch or whatever. This is a horrible way to do business. Give yourself a monthly paycheck if you’re earning enough money, or don’t. But stay out of the till so that you have enough money to pay your obligations.

10- Pay Your Bills On Time

It’s imperative to pay all your bills on time, including your quarterly taxes. Many businesses that otherwise were terrific business ideas have failed due to letting bills get built up too high, especially super large tax bills. Don’t let that happen to you. Set up a budget so that you can withdraw quarterly bills monthly.

By implementing a great accounting application, hiring an expert, and following a few simple rules, you’ll soon find that accounting helps your business become even more profitable than you thought possible.