With many of today’s financial institutions providing customers with the ability to bypass the bank entirely with online banking options, the days of paper checks are numbered. When was the last time you paid your monthly bills with checks? If you can remember a time in the last six months where you paid all of your bills with paper checks, you’re definitely part of the dwindling minority.

Considering how many online tools are available to us, it’s foolish to not take advantage of these technologies. As the years have passed, we’ve seen these online tools evolve into well-rounded financial solutions.

With different tools available to tackle all of your financial tasks, you can have a flawless and secure online financial system working with you to manage all of your financials. While there are several alternatives to each type of technology, here are four online tools that will help you find the easiest and most simple ways to manage your finances online, whether individual or business.

1) Toshl

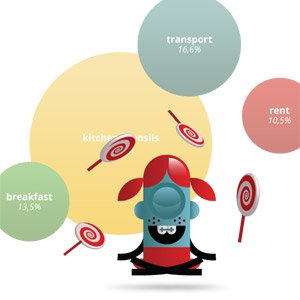

With mobile apps for iPhone and Android, Toshl is an incredible tool for keeping a log of your itemized spending. Helping you better understand your spending habits, Toshl will help you choose the right actions to take in order to change your habits for the better. But until you decide to make these changes, other technological options, such as the next tool we will discuss, you may find yourself in a cloud of confusion and frustration.

Check out Toshl’s tracker to help guide you to financial freedom.

2) Mint

When a complete financial management tool becomes available, people seem to be skeptical of the tool until it withstands the test of time. While there have been numerous companies that have had their systems hacked, Mint has passed this test with flying colors, providing a secure platform that makes managing your finances a breeze.

As you input your account information for all of your bank accounts, credit cards, and investments, you get an idea of your entire financial situation, and better yet, where you stand with each account you have. Offering applications for both tablets and smartphones, Mint provides you the ability to check how much money you currently have, your remaining bills, and a spending breakdown whether you’re at home on your computer or on the go.

3) CapitalOne 360

Formerly known as ING Direct, CapitalOne 360, the new owner of ING, provides users with above-average rates for their accounts, and are able to do so thanks to low overhead costs – no physical bank locations is a huge asset in this. The same industry-standard service as before, CapitalOne 360 helps you manage your account, and is about as simple as it is to update your account from any other banking service. Only with 360, you’ll receive APRs that are reasonable, if not well-above other top lenders’ offers.

4) WePay

While PayPal would have taken the fourth and final place on this list three to five years ago, we aren’t about providing you information on outdated services. While PayPal was one of the few ways one could send and receive money securely outside of their banks, there are more anti-PayPal websites and individuals than ever, and as a result, WePay was created to combat everything users dislike about PayPal.

While WePay makes it possible for freelancers and small businesses to create invoices through its online invoicing system, it handles your fees in a customer service-centric manner, something PayPal cannot claim. With fees at 2.9% for credit cards and just 1% for bank accounts, businesses and freelancers stand to save an abundance of money in their payment processing fees. With PayPal charging 4% for all transactions, it seems WePay has a legitimate chance of leaving PayPal in the dust.